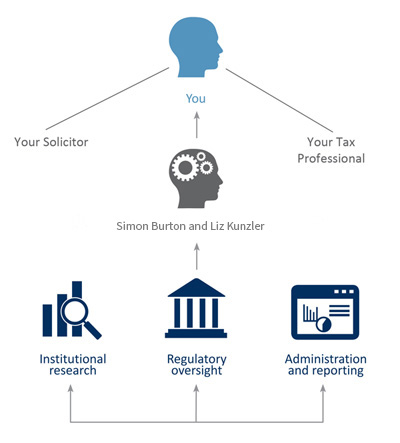

We utilise the extensive resources of Raymond James to meet the needs of our clients. This approach allows us to provide a wide range of solutions by leveraging the expertise of Raymond James, while also collaborating with your existing legal and tax relationships.

We construct portfolios to meet your individual needs. We start with a discussion over a cup of tea to come to an agreement on how you would like your portfolio to be run. To do this we will begin with:

- Appetite for risk

- Capacity for loss

- Desired outcome

Once this has been agreed we will then set about constructing a portfolio for you using the wide array of tools made available to us through being part of Raymond James. Our job is to monitor these over time and ensure that the risk and performance are suitable to be included in your portfolio. We will then sit down with you at regular intervals to review your portfolio and establish whether your needs have changed. This of course complements your ability to view it online at any time or by post should you wish.

SERVICES AT RAYMOND JAMES

UK – We manage investments for all types of accounts including ISAs, SIPPs, offshore bonds, trusts and investment companies.

International – Being able to offer access to an offshore and onshore custodian. We have experience in managing global portfolios in multiple currencies including £, $ & €.

US – We are able to offer US custody enabling us to provide investment services to people who are no longer residing in the USA but still need US brokerage facilities.

Financial Planners – Working alongside your financial planner, we aim to ensure that your investments are run in the most efficient way by sharing information between us.

ACCOUNT TYPES

- Through this service we will manage your portfolio for you on a discretionary basis. This means that we will periodically review your portfolio at agreed intervals, make decisions and take action about the composition of your investments and cash holdings.

- You agree to keep us informed about material changes to your circumstances which may affect the suitability of our ongoing investment decisions. If in doubt you can speak to us at any time.

- We will also establish a relevant benchmark based on your objectives, risk appetite and the assets that will be included in your portfolio, so that you can assess our performance.

- Through this management service, we will recommend an overall structure or investment sector allocation for your portfolio and make proposals that we believe are suitable for you.

- We will periodically review your portfolio at agreed intervals and provide you with a comprehensive valuation report on at least a half-yearly basis. However, we will not take any action without instructions from you. Instructions may be given by telephone, in writing or as otherwise agreed.

- Through this service we will carry out your specific instructions to carry out transactions without providing you with any advice or investment recommendation.

- We will establish your knowledge and experience of dealing in investments so that we can determine whether or not you understand the risks involved with the transaction, but we will not consider whether the transaction is suitable for you.

- Capital Access enables clients on our US platform to manage their day-to-day cash and spending needs in a single account along with their investments.

- Features include: unlimited check writing, Visa® Platinum debit card, access to more than 30,000 surcharge-free ATMs, online account access, online bill payment, overdraft protection, performance reporting.